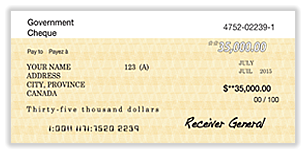

Many people with disabilities are missing valuable tax credits and potential refunds of over $35,000!

CALL NOW!

1.877.340.1833

for your

FREE, NO OBLIGATION

ELIGIBILITY ASSESSMENT

(Or fill out form below. All information remains strictly confidential)

877-340-1833

No Obligation Eligibility Assessment

Understanding and maximizing the income tax savings and Federal Government programs that are now available to people with a disability can be very beneficial. Often these benefits can be realized for up to the past ten years by individuals, family members, and/or estates.

Many people with disabilities are missing valuable tax credits and potential refunds of over $35,000.

Many people with disabilities are missing valuable tax credits and potential refunds of over $35,000.

As highly-qualified tax credit consultants, M.D. Reis & Company does all the work necessary to make sure you receive every $$$ that the Canada Revenue

Agency owes you! Our years of experience will

ensure that people with a disability and their family

members receive all the benefits they deserve.

Now, more than ever, it is crucial to seek professional assistance in order to successfully navigate

the complexities of the income tax act and government bureaucracy. It is time to attain the positive financial results that await you. (click on DISABILITIES

above for a list of just a few of the qualifying disabilities.)

Call now or fill out our Free Eligibility Assessment to see if you qualify. There is no obligation to use our service and all information remains strictly confidential.